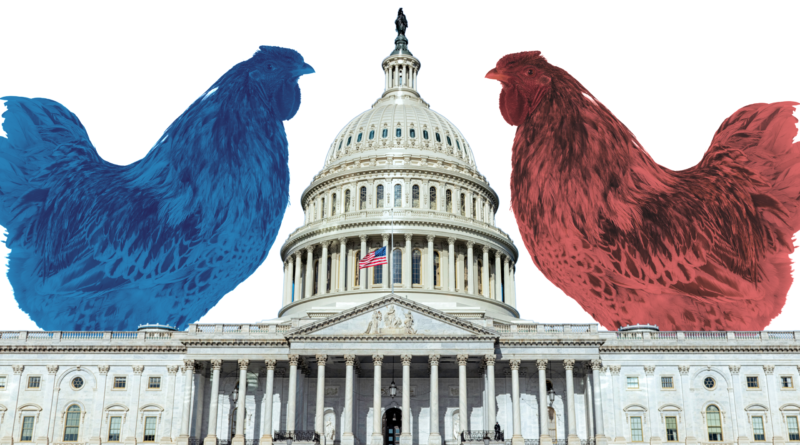

Congress Plays a Fiscal Game of Chicken

The clock is ticking, and lawmakers are embattled in a game of chicken over raising the debt ceiling. On September 30th, at the 11th hour, Congress passed legislation to avoid a partial shutdown and keep the government up and running through December 3rd. That bill was merely a stop-gap measure and included a provision to suspend the debt ceiling. The collective sigh of relief didn’t last long, and now Congress must address the elephant in the room, the debt ceiling.

The debt ceiling is the maximum amount of money the United States Treasury can borrow each month to pay its debts. The borrowed money goes to pay for Social Security benefits, Medicare reimbursements, and other essential things such as tax refunds. However, similar to Americans’ borrowing abilities, the US Treasury can’t write a blank check, nor can it spend like a teenage girl with Daddy’s credit card. To continue borrowing money, the Treasury must get Congressional approval. The approval to increase the debt ceiling would allow the US to make good on its loans and continue to pay its current bills.

Congress instituted the debt limit as part of the Second Liberty Bond Act of 1917. Before the establishment of the debt ceiling, Congress had the tedious task of “approving every issuance of debt separately.” Since then, the debt ceiling has been raised or suspended over 100 times, 80 times since 1960 alone, and in 2019, the debt ceiling was raised three times before Congress agreed to a two-year suspension in August.

Currently, unless Congress acts soon, the US Treasury estimates it will run out of money by October 18th, and Treasury Secretary Janet Yellen is sounding the warning alarm over the catastrophic consequences if the debt ceiling is not raised.

Even though the Democrats control Congress (both the House and the Senate), they are at the mercy of the Republicans who are using the filibuster to force the Democrats’ hands at raising the debt ceiling without bipartisan support. At first blush, it looks like a GOP tool to bludgeon the Democrats into fiscal conservatism; however, it’s not. In fact, the Republican party has a history of weaponizing the debt limit whenever a Democrat occupies the Oval Office.

When Barack Obama was president, the Republicans refused to raise the debt ceiling unless he agreed to spending cuts. Ten years later and not much has changed, the GOP isn’t interested in governing; they are biding their time until the government collapses and they can cut ads for the midterms to blame the Democrats for the government shutting down.

However, the Democrats and President Biden may not need the GOP to get on board to raise the debt ceiling. In fact, the hero of the day may be the most unlikely suspect, Secretary Yellen.

According to Section 31 § 5112 of the US legal code, the Treasury Secretary has the ability to mint and issue platinum coins in any quantity and denomination of their choosing. The original intent was to “put out collectible platinum coins of a variety of sizes.”

Nevertheless, Secretary Yellen could make history by authorizing the US Mint to strike a $1 trillion platinum coin and deposit into the “Federal Reserve and draw on that account to keep paying the government’s bills without borrowing,” raising the debt limit, and not to mention, the government would avoid a shutdown.

While the $1 trillion coin seems like something out of a Nicolas Cage movie, the reality exists, and nothing is prohibiting Secretary Yellen from quietly reaching out to the U.S. Mint director and asking him to warm up the press.

As lawmakers continue to play a fiscal high-risk game of chicken over the debt ceiling and the days are dwindling before the American Treasury runs out of money, even the most out-of-the-box solutions should not be off the table.

The idea of printing money out of thin air makes economists moderately nervous about hyperinflation and concerns political analysts about the weakening of checks and balances between government branches. However, there is an “Act of Congress under power expressly granted to Congress in the Constitution (Article 1, Section 8)” that provides direct authority and discretion on printing and discretion regarding coin specifications, including denominations, to the Secretary of the Treasury.

Unfortunately, Yellen isn’t ready to reenact the famous printing scene from Catch Me If You Can. In a recent interview with CNBC, Secretary Yellen said the coin was a bad idea, stating, “I’m opposed to it and I don’t think we should consider it seriously. It’s really a gimmick and what’s necessary is for Congress to show that the world can count on America paying its debts.”

For now, it looks as though Congressional lawmakers will have to find some common ground and it will start with Democrats recognizing two truths: 1) the GOP isn’t interested in governing and 2) regardless of what happens with the debt ceiling, the GOP will blame the Dems. Once they reconcile these two truths, they’ll be better off. Should Congress fail to avoid a government shutdown, they will have failed at doing their job. And for that, the American people should stand ready to hold them accountable at the ballot box next November.